Wine as an investment

The most important tips for collectors and investors

For many wine collectors and investors, purchasing wine as an investment or for an exclusive wine collection is a fascinating way to combine passion with value appreciation. However, when selecting a high-quality wine, the key question arises: How much does a wine have to cost to truly retain its value and be considered collectible? In this blog post, we explore the key factors that determine the price of a good wine, offer recommendations for investors and collectors, and highlight which wines are particularly suitable as investments.

Why is the price of a wine important?

The price of a wine primarily reflects its quality, rarity, and potential for appreciation. For collectors and investors, it's crucial to choose a wine that not only tastes good today but will also increase in value in the future. Several factors play a role:

- Quality and origin

- Vintage and maturity

- Rarity and limitation

- Wine region and house

- Market demand

- Rating by wine critics

However, a high price alone doesn't guarantee increased value. It's the combination of these factors that counts.

What makes a wine expensive?

1. Quality and grape variety

High-quality grape varieties such as Cabernet Sauvignon, Merlot, Pinot Noir, or Riesling are often more expensive, especially if they come from renowned growing regions. The quality of the terroir—that is, soil composition, climate, and location—significantly influences the taste.

2. Origin & Growing Region

Wines from well-known regions such as Bordeaux (France), Burgundy (France), Tuscany (Italy), Napa Valley (USA), or Rheingau (Germany) usually fetch higher prices. These areas have a reputation for excellence and prestige.

3rd vintage & storability

An outstanding vintage can significantly increase the price. Long-lasting wines with great aging potential often cost more. For example, vintages like 1982 Bordeaux or 2000 Napa Valley are legendary.

Read also: Wine of the Century – Masterpiece of Wine Production

4. Limited production & rarity

Limited editions or rare bottles are sought after by collectors. The rarer a wine, the higher its price can be.

5. Winemaker & Winery

Wines from renowned winemakers or famous cellars command higher prices. Names like Château Lafite-Rothschild , Domaine de la Romanée-Conti, or Screaming Eagle are synonymous with exclusivity.

6. Wine reviews

Wine critics' opinions significantly influence the price of wine. The better the quality and the higher the rating, the more desirable the wine becomes for wine collectors and investors. Wine ratings are an essential part of wine marketing.

How much should a good wine cost?

There's no hard and fast rule as to how much a wine should cost to be considered a good investment. However, some guidelines can be derived:

| Price range | Meaning | Example |

| Under 20 € | Affordable everyday wines | Mass-produced goods without long-term value-added potential |

| 20 - 50 € | Good everyday wines & beginners for collectors | First high-quality bottles with potential |

| 50 - 150 € | High-quality wines with aging potential | Popular vintages from well-known regions |

| 150 - 500 € | Premium wines & rarities | Very good vintages from top winemakers |

| Over 500 € | Luxury & investment wines | Legendary bottles with high value appreciation potential |

Read also: Wine from the supermarket

For a sustainable investment, it is usually advisable to invest in a price range of approximately 50 to 150 euros per bottle – provided the wine comes from a renowned region and has a good vintage.

Which wines are best suited as an investment?

Not every wine is equally suitable for long-term storage or as an investment. Here are some tips:

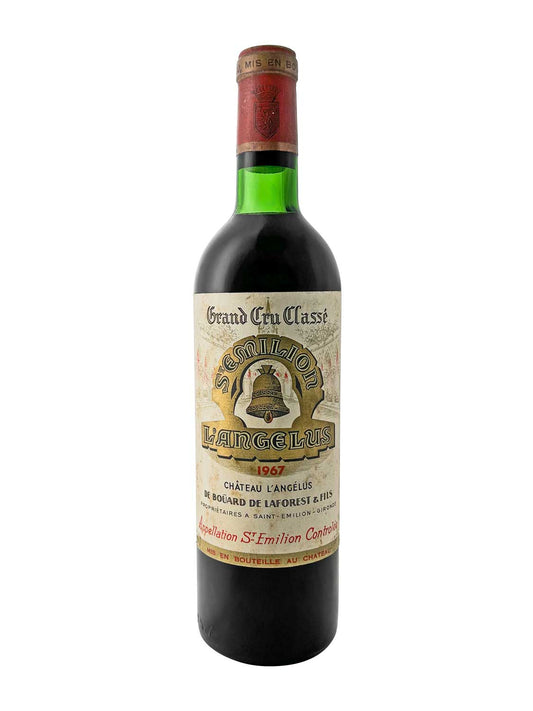

Bordeaux wines: Especially 1er Grand Crus such as Château Latour , Château Haut-Brion or Château Mouton-Rothschild have been popular investments for decades.

Burgundy: Pinot Noir from Burgundy is also considered to be stable in value and rare.

Dessert wines: Sauternes or Trockenbeerenauslese often have a high aging potential, such as Château d'Yquem .

Rarities & limited editions: Bottles with a special history or limited editions increase in value.

What should investors pay attention to when buying?

To make a successful investment, the following points should be considered:

Authenticity: Always check the authenticity of the bottle.

Read also: Wine counterfeiting – the dark side of a wine collection

Storage: Optimal conditions (constant temperature around 12–16°C, humidity approx. 70–85%, darkness) are essential.

Documentation: Keep receipts and provenances carefully.

Longevity: Wine needs time to mature; plan for at least 10-15 years of storage.

Market monitoring: Monitor auctions and market prices regularly.

Conclusion: This is how much a good wine should cost

It largely depends on your goal: Do you want to build a personal collection or invest in wines as assets? To get started, experts recommend a middle ground between €50 and €150 per bottle for selected top vintages from renowned regions.

The most important factors are the quality of the wine, its aging potential, and its rarity. High-priced wines starting at around €200, especially from well-known winemakers or from legendary vintages, often offer the greatest potential for appreciation.

In conclusion, the best wine for your collection is the one you personally like – but if you are looking for long-term value, you should invest specifically in tried-and-tested classics.