The most valuable collector wines of 2025

What wine lovers and investors need to know now

The world of wine collectors and investors is constantly evolving. Bordeaux, Burgundy, and other premium wine regions, in particular, offer not only enjoyment but also long-term appreciation in value . For collectors and investors who want to strategically build their wine collections, it is crucial to be aware of current trends, rare vintages, and the factors that determine value .

This article will tell you which wines are particularly interesting in 2025, what you should pay attention to when making your selection, and how to optimally combine collectibles and investments .

Why wine is becoming increasingly popular as a collector's item and investment

Wine has been considered a stable tangible asset for years , combining inflation protection with prestige. While classic asset classes like stocks and real estate can be affected by volatility, premium wines benefit from rising demand, limited stocks, and historical significance.

Collectors focus on:

- Rare vintages (e.g. Bordeaux 1945, 1982 or Burgundy 2005)

- Historical provenance (secure origin and documented storage)

- Well-known wineries with a global reputation

Investors also pay attention to market trends , secondary market prices , and the liquidity of the bottles . Studies show that well-selected premium wines can achieve average returns of 8–12% per year over decades ( Liv-Ex Market Reports ).

Top vintages for collectors and investors 2025

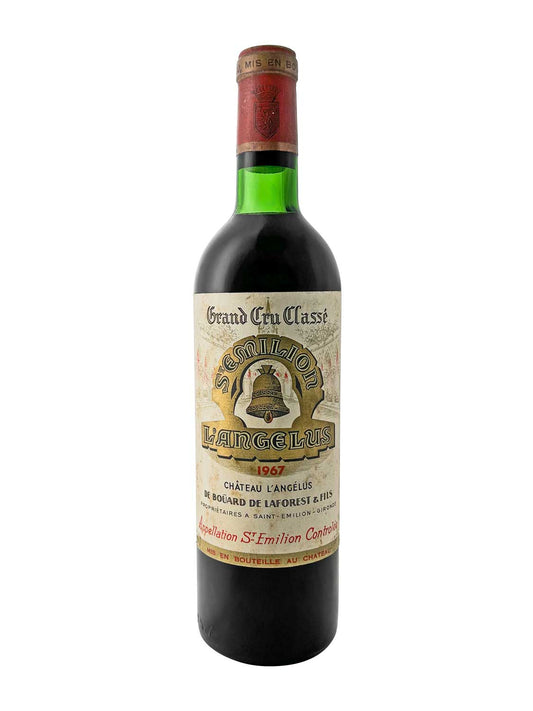

1. Bordeaux – the classics for long-term investments

Bordeaux remains the leading region for premium wines . Particularly interesting for 2025 are:

- 1945, 1947, 1949 – legendary vintages of the century, extremely rare and stable in value

- 1982, 1989 – highly sought-after vintages, traded internationally

- 2000, 2005, 2009 – young classics that have already increased significantly in price.

Investment tip: Pay attention to original provenance , storage history and authentic labels to minimize the risk of counterfeiting .

2. Burgundy – small quantities, high demand

Burgundy wines are particularly attractive due to their small production volumes . Collectors focus on:

- Domaine de la Romanée-Conti

- Leroy, Rousseau, Rousseau Chambertin

The combination of limited supply and high global demand is driving prices further upwards.

Value factors: What collectors and investors should pay attention to

| factor | Significance for value appreciation | Tips |

|---|---|---|

| Provenance | Bottle demonstrably stored correctly | Always check certificates and auction history. |

| vintage | Historic or particularly rare vintages | Focus on legendary Bordeaux and Burgundy vintages |

| storage | Optimal temperature, humidity, and light protection | Storage in professional climate chambers or wine cellars |

| Winery | Reputation and prestige | Premier Crus, Grand Crus and historic wineries are preferred |

| Market trends | Demand on the secondary market | Monitor price trends via Liv-Ex or Wine-Searcher |

New trends among collectors and investors

-

Sustainability & Biodynamics

More and more buyers are looking for sustainably produced wines and premium wines from biodynamic wineries ( Wine-Searcher Trend Report 2025 ). -

Digital Provenance & Blockchain

To prevent counterfeits, modern collectors rely on digital certificates of authenticity , which increase transparency and trust. -

Alternative investment options

Besides physical bottles, investors are increasingly interested in wine funds or exclusive online wine auctions that appeal to global buyer groups.

FAQ

Which vintages are particularly suitable for wine investments in 2025?

- Bordeaux: 1945, 1982, 2000

- Burgundy: DRC 2005, Leroy 2009

- Tip: Focus on limited quantities and documented provenance.

How do I identify wines that increase in value as collector's items?

- Provenance, vintage, winery, storage, secondary market trends

How can I invest safely in wine?

- Acquisition through established dealers or auctions

- Check authenticity

- Consider long-term investment planning

Conclusion

For collectors and investors, 2025 is an ideal year to strategically acquire high-quality wines. The combination of historic vintages, limited quantities, and sustainable value appreciation makes Bordeaux and Burgundy among the most attractive regions. Those who pay close attention to provenance, storage, and market trends can build a secure wine portfolio and benefit from long-term value growth.

Start your wine portfolio now: Visit our shop and secure limited vintages for long-term appreciation → Collect wine