Should I insure my wine?

Guide: Insurance for your wine cellar

Collecting wine is not just a hobby, but often also a valuable investment. Whether you're a passionate wine collector or simply saving a few precious bottles for special occasions, the question of insuring your wine is a crucial one. In this blog post, we'll discuss the reasons why it might be a good idea to insure your wine, what options are available, and what to look out for.

Why should you insure your wine?

1. Protection against loss or damage

Wine is delicate and can be damaged by various factors, including:

Water damage: Leaks or flooding can seriously endanger your collection.

Also read: What to do if you don’t have a wine cellar?

Fire: A fire can destroy not only your home but also your valuable bottles.

Theft: A well-stocked wine collection can be an attractive target for burglars.

Insurance protects you from the financial consequences of such events and ensures that you are compensated in the event of damage.

2. Increase the value of your wines

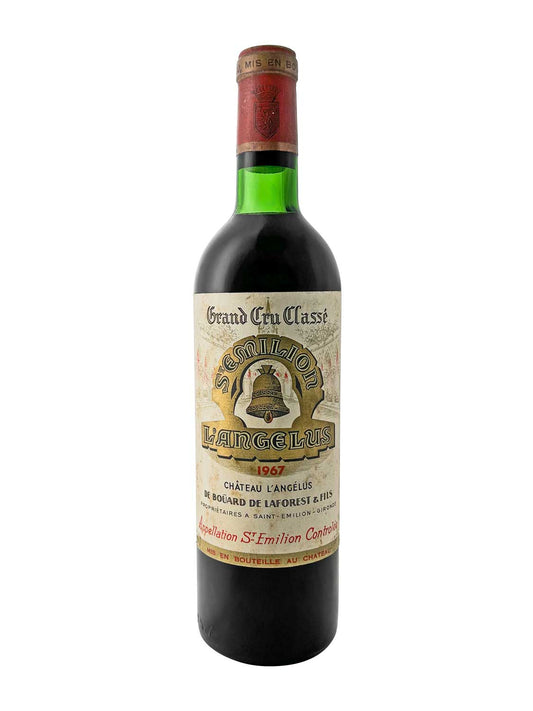

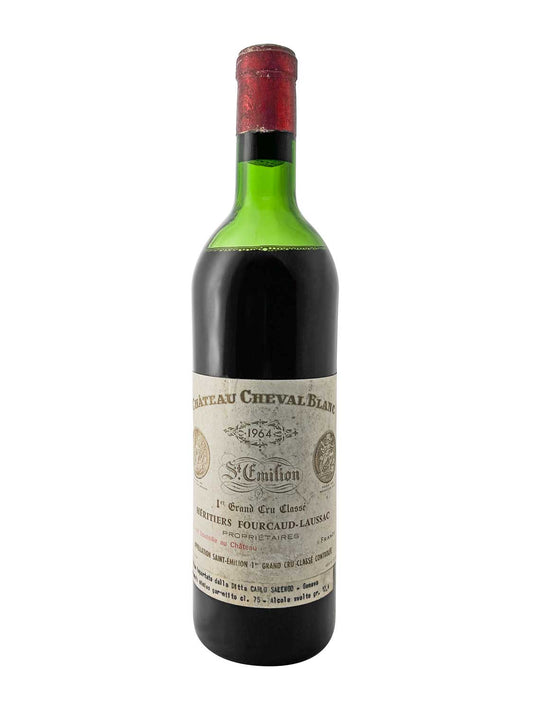

Many wine collectors invest in high-quality wines that can increase in value over time. Rare vintages or limited editions are particularly sought after and can fetch significant sums. As your collection increases in value, it becomes even more important to protect it accordingly. Insurance ensures that you receive the current market value of your wines in the event of a loss.

Read also: Why a bottle of Château Mouton-Rothschild is so expensive

3. Calming the conscience

Knowing that your wine collection is insured gives you peace of mind. You can store your wine bottles with confidence and focus on discovering new wines without constantly worrying about potential damage.

What types of insurance are there?

There are several ways to insure your wine:

1. Home contents insurance

In many cases, wine is included in home contents insurance. However, it's important to check whether the value of your collection is within the coverage limit and whether special conditions apply. There are often limits for certain items, such as works of art or collectibles.

2. Special insurance for collections

Some insurance companies offer special collection policies tailored to wine collectors. These policies typically cover higher values and offer more comprehensive protection options than traditional home insurance.

3. Transport insurance

If you plan to transport your wine—whether for a tasting or a move—you should consider transport insurance. This protects your bottles from damage or loss during transit.

What should you look for when insuring your wine?

1. Evaluation of your collection

Before purchasing insurance, you should determine the value of your collection. Have a professional appraisal performed or use online resources for rare wine pricing. This will help you determine the right coverage amount.

2. Documentation

Keep a detailed list of your wines, including information such as vintage, producer, and purchase price. Photograph each bottle and retain all receipts. This documentation is crucial for insurance claims in the event of a loss.

3. Check conditions and exclusions

Read the insurance terms and conditions carefully and pay attention to any exclusions or restrictions regarding the storage and transport of wine bottles. For example, some policies may not cover damage caused by improper storage.

Also read: How long can you store white wine?

4. Compare premiums

Compare different insurance providers and their premiums and benefits. Make sure the policy meets your individual needs and offers adequate coverage.

Conclusion: Does insurance for your wine collection make sense?

The decision whether to insure your wines depends on several factors, including the value of the collection, the risk of damage, and personal preferences regarding security and protection.

For many wine collectors, insurance is a wise investment to protect their valuable bottles from unforeseen events such as theft or water damage. Especially if your collection consists of high-quality or rare wines, a specialized insurance policy can provide you with the necessary protection.

Ultimately, you should do your research and consider all options before making a decision. A well-documented and appraised collection, along with appropriate insurance, will ensure that your wine hobby offers both enjoyment and security.

By following these steps and learning about the different insurance options, you can ensure that your passion for wine remains not just a hobby, but also a financially secure investment!